Multiple Choice

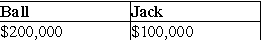

Ball Corporation owns 80% of Net Corporation's stock and Jack owns the remaining 20% of Net Corporation's stock. Ball's basis in the Net stock is $200,000 and Jack's basis in the Net stock is $100,000. Under a plan of complete liquidation, Ball Corporation receives property with an adjusted basis of $400,000 and an FMV of $800,000 and Jack receives property with an adjusted basis of $50,000 and an FMV of $200,000. Ball and Jack's bases in the property received are:

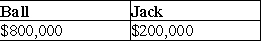

A)

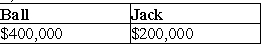

B)

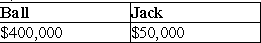

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q45: Liquidation rules generally are applied the same

Q46: Carly owns 25% of Base Corporation's single

Q47: In a complete liquidation of a corporation,

Q48: Identify which of the following statements is

Q49: Under a plan of complete liquidation, Key

Q51: Identify which of the following statements is

Q52: Liquidating expenses are generally deducted as ordinary

Q53: Under the general liquidation rules, Kansas Corporation

Q54: Identify which of the following statements is

Q55: Last year, Toby made a capital contribution