Multiple Choice

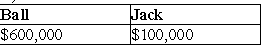

Ball Corporation owns 80% of Net Corporation's stock and Jack owns the remaining 20% of Net Corporation's stock. Ball's basis in the Net stock is $200,000 and Jack's basis in the Net stock is $100,000. Under a plan of complete liquidation, Ball Corporation receives property with an adjusted basis of $400,000 and an FMV of $800,000 and Jack receives property with an adjusted basis of $50,000 and an FMV of $200,000. Ball and Jack's recognized gains on the liquidation are:

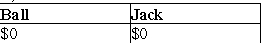

A)

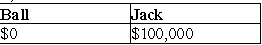

B)

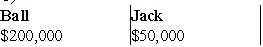

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q72: Parent Corporation for ten years has owned

Q73: How is the gain/loss calculated if a

Q74: Greg, a cash method of accounting taxpayer,

Q75: What basis do both the parent and

Q76: Jack has a basis of $36,000 in

Q78: Hope Corporation was liquidated four years ago.

Q79: Moya Corporation adopted a plan of liquidation

Q80: Identify which of the following statements is

Q81: Toby made a capital contribution of a

Q82: Parent Corporation owns 80% of the stock