Essay

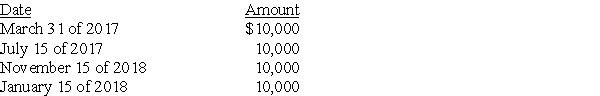

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset). The stock was acquired three years ago. He receives the following distributions as part of a plan of liquidation of Acorn Corporation:  What are the amount and character of the gain or loss that Jack will recognize during 2017? During 2018?

What are the amount and character of the gain or loss that Jack will recognize during 2017? During 2018?

Correct Answer:

Verified

Because Jack's $36,000 basis has not bee...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q71: Santa Fe Corporation adopts a plan of

Q72: Parent Corporation for ten years has owned

Q73: How is the gain/loss calculated if a

Q74: Greg, a cash method of accounting taxpayer,

Q75: What basis do both the parent and

Q77: Ball Corporation owns 80% of Net Corporation's

Q78: Hope Corporation was liquidated four years ago.

Q79: Moya Corporation adopted a plan of liquidation

Q80: Identify which of the following statements is

Q81: Toby made a capital contribution of a