Multiple Choice

The following information relates to Questions 1-6

katrina black, portfolio manager at Coral bond Management, ltd., is conducting a training session with alex Sun, a junior analyst in the fixed income department. black wants to ex-plain to Sun the arbitrage-free valuation framework used by the firm. black presents Sun with exhibit 1, showing a fictitious bond being traded on three exchanges, and asks Sun to identify the arbitrage opportunity of the bond. Sun agrees to ignore transaction costs in his analysis.exhibit 1 Three-Year, €100 par, 3.00% Coupon, annual-Pay option-Free bond

black shows Sun some exhibits that were part of a recent presentation. exhibit 3 presents most of the data of a binomial lognormal interest rate tree fit to the yield curve shown in ex-hibit 2. exhibit 4 presents most of the data of the implied values for a four-year, option-free, annual-pay bond with a 2.5% coupon based on the information in exhibit 3.exhibit 2 Yield to Maturity Par rates for one-, two-, and Three-Year annual-Pay option-Free bonds

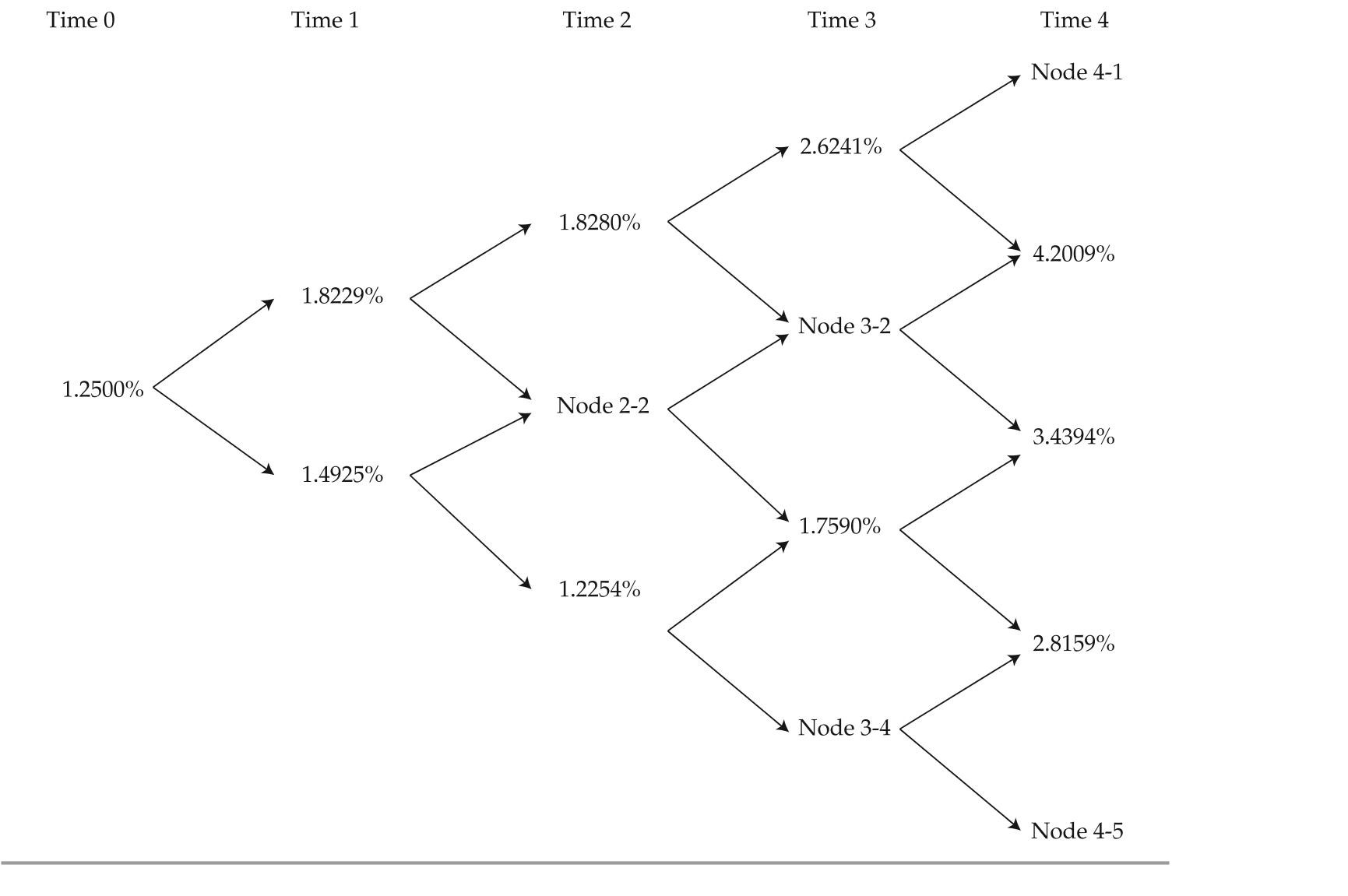

exhibit 3 binomial interest rate tree Fit to the Yield Curve (Volatility = 10%)

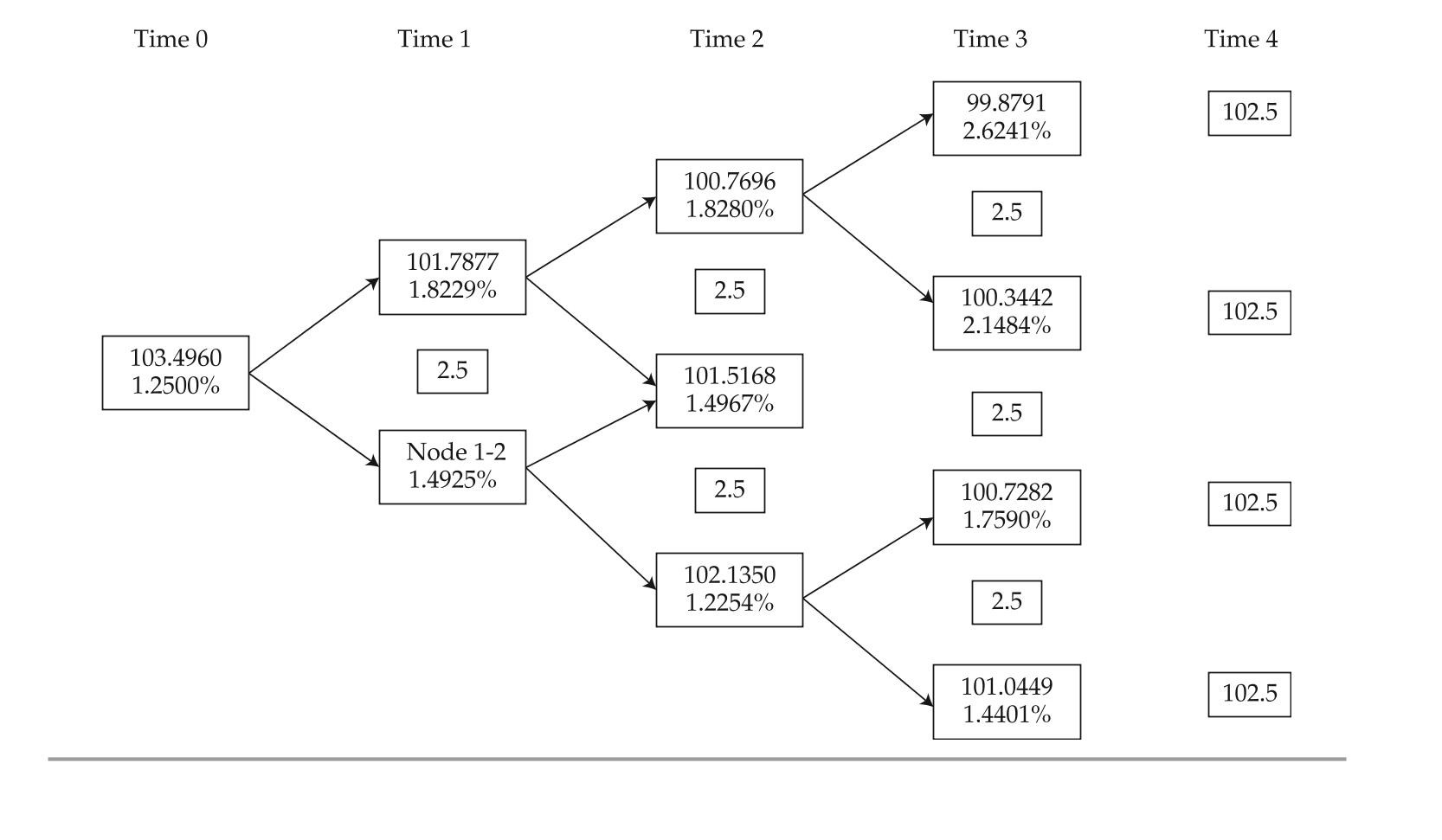

exhibit 4 implied Values (in euros) for a 2.5%, Four-Year, option-Free, annual-Pay bond based on exhibit 3

exhibit 4 implied Values (in euros) for a 2.5%, Four-Year, option-Free, annual-Pay bond based on exhibit 3

black asks about the missing data in exhibits 3 and 4 and directs Sun to complete the following tasks related to those exhibits:

black asks about the missing data in exhibits 3 and 4 and directs Sun to complete the following tasks related to those exhibits:

task 1 test that the binomial interest tree has been properly calibrated to be arbitrage-free.

task 2 Develop a spreadsheet model to calculate pathwise valuations. to test the ac-curacy of the spreadsheet, use the data in exhibit 3 and calculate the value of the bond if it takes a path of lowest rates in Year 1 and Year 2 and the second lowest rate in Year 3.

task 3 identify a type of bond where the Monte Carlo calibration method should be used in place of the binomial interest rate method.

task 4 update exhibit 3 to reflect the current volatility, which is now 15%.

-which of the following statements about the missing data in exhibit 3 is correct?

A) node 3-2 can be derived from node 2-2.

B) node 4-1 should be equal to node 4-5 multiplied by

C) node 2-2 approximates the implied one-year forward rate two years from now.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The following information relates to Questions

Q8: The following information relates to Questions

Q9: The following information relates to Questions

Q10: The following information relates to Questions

Q11: The following information relates to Questions

Q12: The following information relates to Questions

Q13: The following information relates to Questions

Q14: The following information relates to Questions

Q15: The following information relates to Questions

Q17: The following information relates to Questions