Multiple Choice

The following information relates to Questions 1-6

katrina black, portfolio manager at Coral bond Management, ltd., is conducting a training session with alex Sun, a junior analyst in the fixed income department. black wants to ex-plain to Sun the arbitrage-free valuation framework used by the firm. black presents Sun with exhibit 1, showing a fictitious bond being traded on three exchanges, and asks Sun to identify the arbitrage opportunity of the bond. Sun agrees to ignore transaction costs in his analysis.exhibit 1 Three-Year, €100 par, 3.00% Coupon, annual-Pay option-Free bond

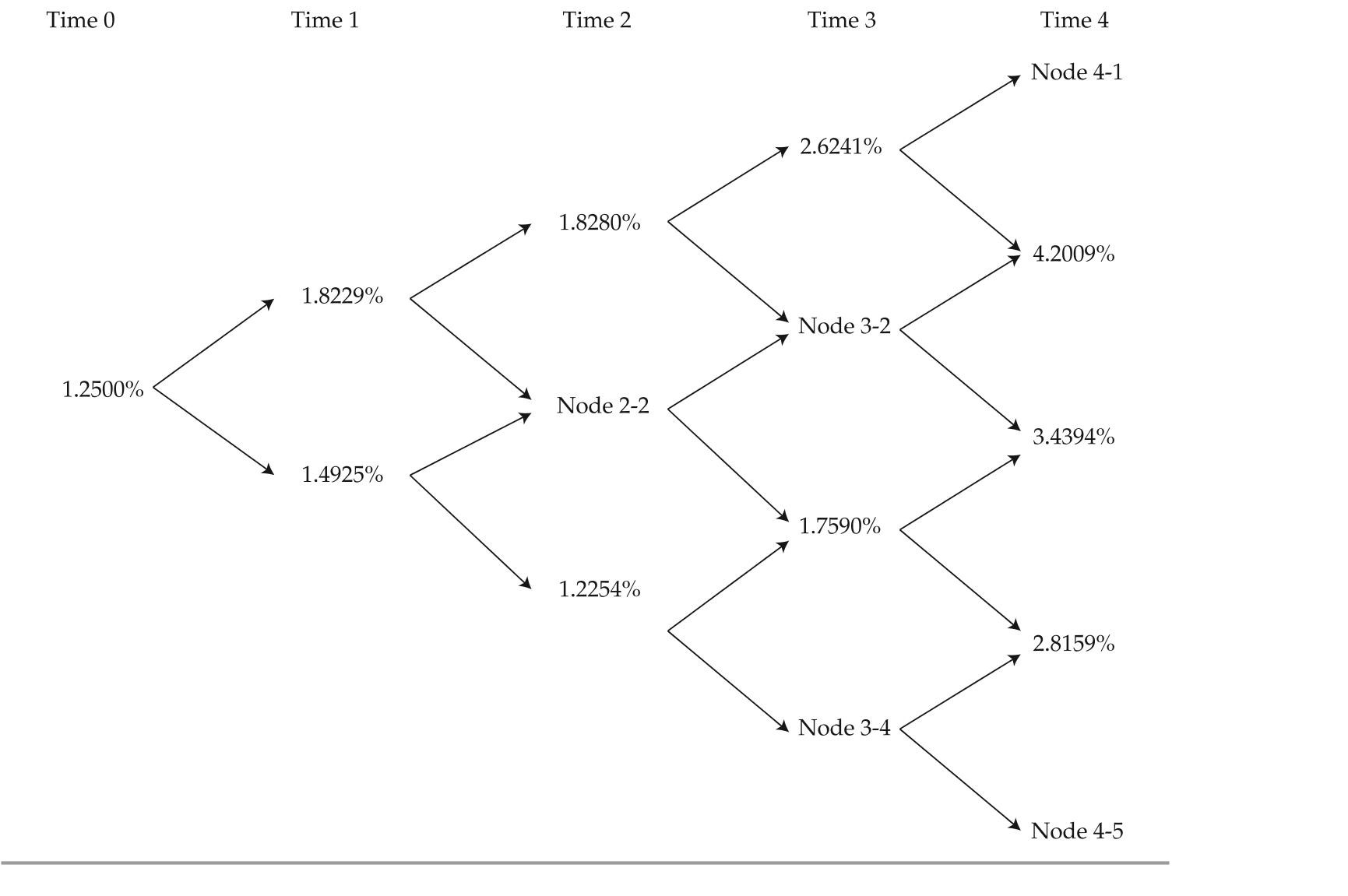

black shows Sun some exhibits that were part of a recent presentation. exhibit 3 presents most of the data of a binomial lognormal interest rate tree fit to the yield curve shown in ex-hibit 2. exhibit 4 presents most of the data of the implied values for a four-year, option-free, annual-pay bond with a 2.5% coupon based on the information in exhibit 3.exhibit 2 Yield to Maturity Par rates for one-, two-, and Three-Year annual-Pay option-Free bonds

exhibit 3 binomial interest rate tree Fit to the Yield Curve (Volatility = 10%)

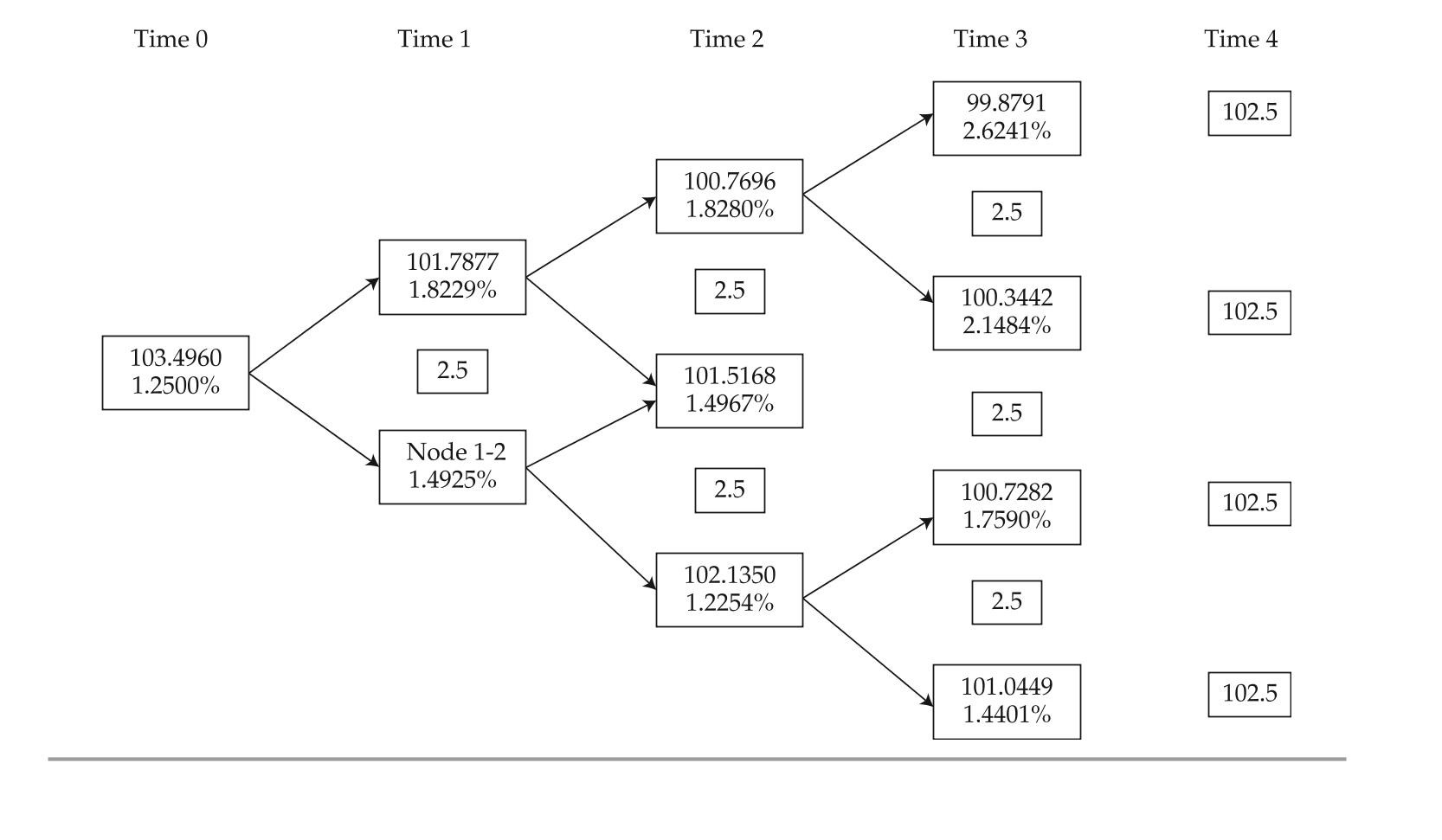

exhibit 4 implied Values (in euros) for a 2.5%, Four-Year, option-Free, annual-Pay bond based on exhibit 3

exhibit 4 implied Values (in euros) for a 2.5%, Four-Year, option-Free, annual-Pay bond based on exhibit 3

black asks about the missing data in exhibits 3 and 4 and directs Sun to complete the following tasks related to those exhibits:

black asks about the missing data in exhibits 3 and 4 and directs Sun to complete the following tasks related to those exhibits:

task 1 test that the binomial interest tree has been properly calibrated to be arbitrage-free.

task 2 Develop a spreadsheet model to calculate pathwise valuations. to test the ac-curacy of the spreadsheet, use the data in exhibit 3 and calculate the value of the bond if it takes a path of lowest rates in Year 1 and Year 2 and the second lowest rate in Year 3.

task 3 identify a type of bond where the Monte Carlo calibration method should be used in place of the binomial interest rate method.

task 4 update exhibit 3 to reflect the current volatility, which is now 15%.

-a benefit of performing task 1 is that it:

A) enables the model to price bonds with embedded options.

B) identifies benchmark bonds that have been mispriced by the market.

C) allows investors to realize arbitrage profits through stripping and reconstitution.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The following information relates to Questions

Q8: The following information relates to Questions

Q9: The following information relates to Questions

Q10: The following information relates to Questions

Q11: The following information relates to Questions

Q13: The following information relates to Questions

Q14: The following information relates to Questions

Q15: The following information relates to Questions

Q16: The following information relates to Questions

Q17: The following information relates to Questions