Multiple Choice

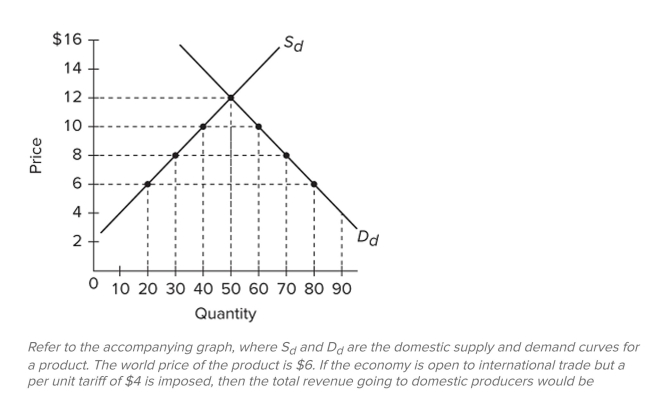

A) $400, the total revenue (after tariff) going to foreign producers would be $120, and the tariff revenue going to the government would be $80.

B) $240, the total revenue (after tariff) going to foreign producers would be $240, and the tariff revenue going to the government would be $80.

C) $400, the total revenue (after tariff) going to foreign producers would be $240, and the tariff revenue going to the government would be $80.

D) $240, the total revenue (after tariff) going to foreign producers would be $120, and the tariff revenue going to the government would be $120.

Correct Answer:

Verified

Correct Answer:

Verified

Q243: The tables give production possibilities data

Q244: The increased-domestic-employment argument for tariff protection holds

Q245: <span class="ql-formula" data-value="\begin{array}{l}\text { Domestic Market For

Q246: A natural-resource abundant nation would be expected

Q247: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" Refer to the

Q249: What is the Trade Adjustment Assistance Act?

Q250: Tariffs create larger gains to domestic producers

Q251: Which of the following best describes economists'

Q252: NAFTA established a free-trade area and eliminated

Q253: Research studies indicate that<br>A) U.S. producers gain