Multiple Choice

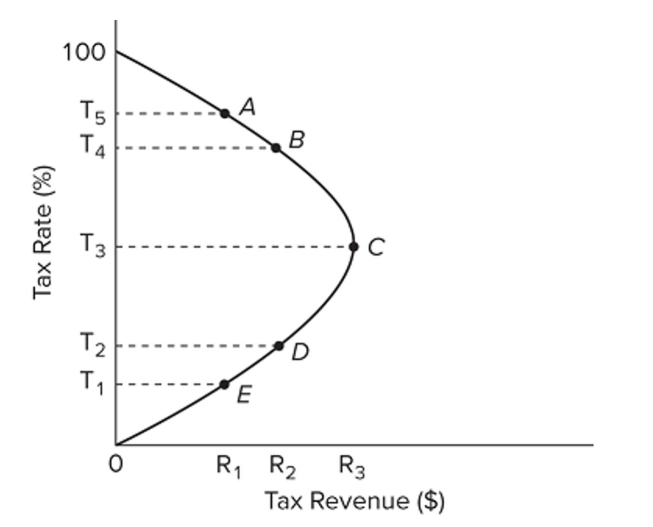

Refer to the Laffer Curve. A cut in the tax rate from T would

Refer to the Laffer Curve. A cut in the tax rate from T would

A) decrease tax revenues and support the views of supply-side economists.

B) increase tax revenues and support the views of supply-side economists.

C) increase tax revenues and support the views of mainstream economists.

D) decrease tax revenues and support the views of mainstream economists.

Correct Answer:

Verified

Correct Answer:

Verified

Q43: Equilibrium in the long run occurs when<br>A)

Q44: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" Refer

Q45: If government uses fiscal policy to restrain

Q46: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" Refer to the

Q47: The traditional Phillips Curve suggests a trade-off

Q49: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" Refer to the

Q50: What is supply-side economics?

Q51: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" A) v. B)

Q52: Inflation in the U.S. economy tends to

Q53: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8601/.jpg" alt=" A)