Multiple Choice

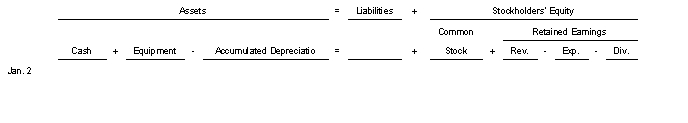

Equipment was purchased for $85000 on January 2 2022.Freight charges amounted to $3500 and there was a cost of $10000 for building a foundation and installing the equipment.The company purchased a special insurance policy for the equipment with a monthly premium of $500.Use the following tabular analysis to record these expenditures assuming that all payments were made in cash.

A) Increase Equipment $98500 increase Insurance Expense $500 and decrease Cash $99000.

B) Increase Equipment $95000 increase Freight Expense $3500 increase Insurance Expense $500 and decrease Cash $99000.

C) Increase Equipment $85000 and decrease Cash $85000.

D) Increase Equipment $85000 decrease Accumulated Depreciation $13500 increase Insurance Expense $500 and decrease Cash $$85500.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: Once cost is established for a plant

Q93: Which of the following is not properly

Q103: The cost of an intangible asset must

Q132: Pearson Company bought a machine on January

Q169: Companies may disclose in the balance sheet

Q170: On July 1 2018 Graunke Company purchased

Q172: A truck costing $72000 and on which

Q174: An asset was purchased for $140,000.It had

Q175: The cost of successfully defending a patent

Q176: On January 2 2022 High Country Corporation