Multiple Choice

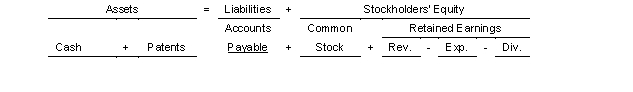

On July 1 2018 Graunke Company purchased a patent from Chimney Rock Company for $8000000.It was estimated that the patent has a remaining useful life of 4 years.On July 1 2022 Graunke retired the asset.Use the following tabular analysis to make the adjustment for retirement assuming that the cost has been fully amortized.

A) Increase Expenses and decrease Patents $2000000.

B) Decrease Patents and increase Expenses $1000000

C) Increase Revenues and decrease Patents $8000000.

D) The Patent account would have a zero balance so no entry would be needed.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: Once cost is established for a plant

Q93: Which of the following is not properly

Q103: The cost of an intangible asset must

Q132: Pearson Company bought a machine on January

Q169: Companies may disclose in the balance sheet

Q171: Equipment was purchased for $85000 on

Q172: A truck costing $72000 and on which

Q174: An asset was purchased for $140,000.It had

Q175: The cost of successfully defending a patent

Q258: The cost of a patent should be