Multiple Choice

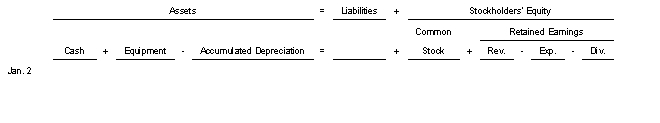

Carnival Corporation purchased a limousine for $185000 on June 2 2022.Sales taxes amounted to $3500 and there was a cost of $10000 for painting the company's logo on the side.The company paid for two employees to attend a training course and get chauffers' licenses at a cost of $2500.Use the following tabular analysis to show the effect of these expenditures on Carnival's accounts assuming that all payments were made in cash.

A) Increase Equipment $198500 increase expense $2500 and decrease Cash $201000.

B) Increase Equipment $195000 increase expenses $5000 and decrease Cash $201000.

C) Increase Equipment $185000 and decrease Cash $185000.

D) Increase Equipment $188500 increase expenses $12500 and decrease Cash $201000.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: Depreciation is the process of allocating the

Q73: On January 2 2002 equipment with a

Q74: The balance in Accumulated Depreciation represents the<br>A)cash

Q75: Wesley Hospital installs a new parking lot.The

Q109: If disposal of a plant asset occurs

Q132: A plant asset must be fully depreciated

Q139: The book value of an asset will

Q141: Which of the following assets does not

Q161: Equipment costing $105,000 with a salvage value

Q276: All plant assets (fixed assets) must be