Multiple Choice

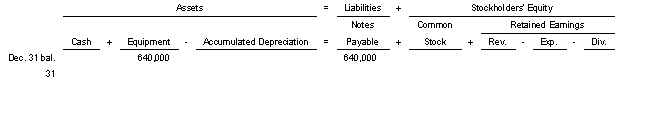

On January 2 2002 equipment with a cost of $640000 was purchased in exchange for a note.The equipment has an estimated salvage value of $60000 and an estimated life of 12000 hours.It is to be depreciated by the units-of-activity method.Use the following tabular analysis to determine the adjustment that would be made for depreciation for the first full year if the equipment was used 3000 hours.

A) Increase Accumulated Depreciation and decrease Depreciation Expense by $160000.

B) Decrease Equipment and Notes Payable by $160000.

C) Decrease Equipment and increase Depreciation Expense by $145000.

D) Increase Accumulated Depreciation and Depreciation Expense by $145000.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: Depreciation is the process of allocating the

Q68: Rains Company purchased equipment on January 1

Q72: A machine costing $176000 was destroyed when

Q74: The balance in Accumulated Depreciation represents the<br>A)cash

Q75: Wesley Hospital installs a new parking lot.The

Q78: Carnival Corporation purchased a limousine for $185000

Q118: A change in the estimated useful life

Q141: Which of the following assets does not

Q208: National Molding is building a new plant

Q216: Pearson Company bought a machine on January