Multiple Choice

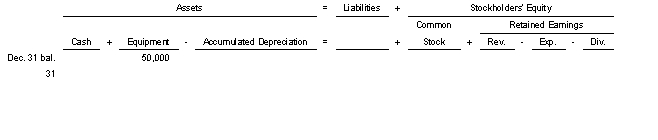

On July 2 2022 equipment with a cost of $50000 was purchased for cash.The equipment has an estimated salvage value of $6000 and an estimated life of 4 years.It is to be depreciated by the straight-line method.Use the following tabular analysis to determine the adjustment that would be made for depreciation for 2022 assuming the company has a calendar year end.

A) Increase Accumulated Depreciation and decrease Depreciation Expense by $11000.

B) Decrease Equipment and increase Depreciation Expense by $11000.

C) Decrease Equipment and increase Depreciation Expense by $5500.

D) Increase Accumulated Depreciation and Depreciation Expense by $5500.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The book value of a plant asset

Q25: Which of the following is not true

Q50: Mitchell Corporation bought equipment on January 1,

Q54: When an asset is sold, a gain

Q62: Equipment with a cost of $640,000 has

Q98: The Accumulated Depreciation account represents a cash

Q107: Mitchell Corporation bought equipment on January 1,

Q151: On January 2 2022 Niceville Corporation sold

Q152: A truck costing $75000 and on which

Q189: Cost allocation of an intangible asset is