Multiple Choice

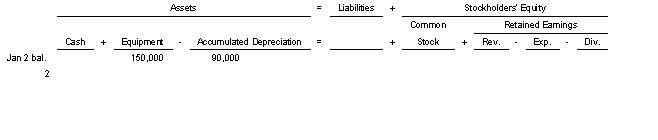

On January 2 2022 Niceville Corporation sold equipment for $40000 cash.The equipment had an original cost of $150000 and accumulated depreciation of $90000.Use the following tabular analysis to record the sale.

A) Increase Cash $40000 decrease Equipment $150000 decrease Accumulated Depreciation $90000 and increase Revenues $20000.

B) Increase Cash $40000 decrease Equipment $60000 and decrease Revenues $20000.

C) Increase Cash $40000 increase expenses (loss) $20000 decrease Equipment $150000 and decrease Accumulated Depreciation $90000.

D) Increase Cash and decrease Equipment $40000.

Correct Answer:

Verified

Correct Answer:

Verified

Q54: When an asset is sold, a gain

Q62: Equipment with a cost of $640,000 has

Q110: The four subdivisions for plant assets are<br>A)

Q123: Ron's Quik Shop bought equipment for $140,000

Q148: Franchises are classified as a plant asset.

Q150: On Oct 1 2021 Metro Company purchased

Q152: A truck costing $75000 and on which

Q156: On January 1, a machine with a

Q156: On July 2 2022 equipment with a

Q189: Cost allocation of an intangible asset is