Multiple Choice

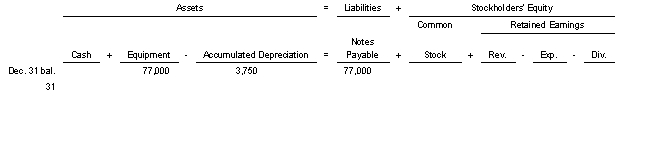

On Oct 1 2021 Metro Company purchased equipment in exchange for a $77000 note payable.The equipment has an estimated salvage value of $17000 an estimated life of 4 years and is depreciated by the straight-line method.Use the following tabular analysis to determine the book value of the equipment at December 31 2022.

A) $56250.

B) $58250.

C) $31250.

D) $27000.

Correct Answer:

Verified

Correct Answer:

Verified

Q54: When an asset is sold, a gain

Q62: Equipment with a cost of $640,000 has

Q110: The four subdivisions for plant assets are<br>A)

Q123: Ron's Quik Shop bought equipment for $140,000

Q148: Franchises are classified as a plant asset.

Q151: On January 2 2022 Niceville Corporation sold

Q152: A truck costing $75000 and on which

Q156: On January 1, a machine with a

Q189: Cost allocation of an intangible asset is

Q229: The IRS does not require the taxpayer