Multiple Choice

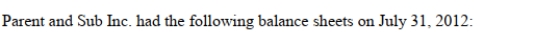

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming once again that the Proprietary Theory was applied, what would be the amount of Goodwill appearing on the Consolidated Balance Sheet on the Date of acquisition, assuming once again that Parent purchased 80% of Sub Inc. for $180,000 on August 1, 2012?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming once again that the Proprietary Theory was applied, what would be the amount of Goodwill appearing on the Consolidated Balance Sheet on the Date of acquisition, assuming once again that Parent purchased 80% of Sub Inc. for $180,000 on August 1, 2012?

A) $72,000

B) $88,000

C) Nil

D) Cannot be determined from the information given.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: A business combination involves a contingent consideration.

Q12: Under the Proprietary theory, Non-Controlling Interest is:<br>A)

Q14: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" On

Q15: Non-Controlling Interest is presented under the Liabilities

Q16: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q18: One weakness associated with the Entity Theory

Q20: When a contingent consideration arising from a

Q24: The purchase price of an entity includes:<br>A)

Q47: When a contingent consideration arising from a

Q53: Any negative goodwill arising on the date