Essay

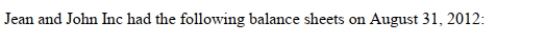

On August 31, 2012, Jean's date of acquisition, Jean Inc. purchased 90% of John Inc for $400,000. Prepare Jean Inc's consolidated Balance Sheet on the date of acquisition using the Proprietary Theory.

On August 31, 2012, Jean's date of acquisition, Jean Inc. purchased 90% of John Inc for $400,000. Prepare Jean Inc's consolidated Balance Sheet on the date of acquisition using the Proprietary Theory.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: A business combination involves a contingent consideration.

Q12: Under the Proprietary theory, Non-Controlling Interest is:<br>A)

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q15: Non-Controlling Interest is presented under the Liabilities

Q16: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q18: One weakness associated with the Entity Theory

Q20: When a contingent consideration arising from a

Q43: What value should be recorded as the

Q47: When a contingent consideration arising from a

Q53: Any negative goodwill arising on the date