Multiple Choice

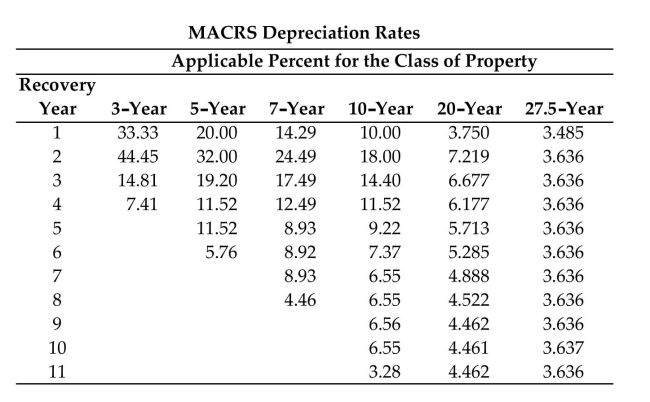

Find the book value using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

-Cost: $400,000

Recovery Period: 10-year

After: First Year

A) $360,000

B) $328,000

C) $302,040

D) $342,840

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Solve the problem.<br>-A drill press cost $5,000

Q23: Find the sum-of-the-years'-digits depreciation fraction for the

Q24: Use the MACRS depreciation rates table to

Q25: Find the first year's depreciation using the

Q26: Provide an appropriate response.<br>-Explain in your own

Q28: Solve the problem.<br>-Tech Support Associates purchased a

Q29: Find the annual amount of depreciation using

Q30: Use the MACRS depreciation rates table to

Q31: Provide an appropriate response.<br>-Describe three features that

Q32: Find the book value to the nearest