Multiple Choice

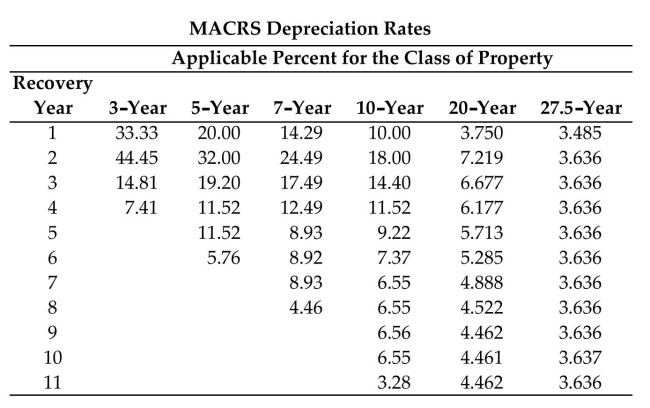

Find the first year's depreciation using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

-Cost: $9,040

Period: 3-year

A) $1,339

B) $3,013

C) $1,808

D) $1,736

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Find the book value after the given

Q21: Find the annual double-declining-balance (200% method) rate

Q22: Solve the problem.<br>-A drill press cost $5,000

Q23: Find the sum-of-the-years'-digits depreciation fraction for the

Q24: Use the MACRS depreciation rates table to

Q26: Provide an appropriate response.<br>-Explain in your own

Q27: Find the book value using the MACRS

Q28: Solve the problem.<br>-Tech Support Associates purchased a

Q29: Find the annual amount of depreciation using

Q30: Use the MACRS depreciation rates table to