Multiple Choice

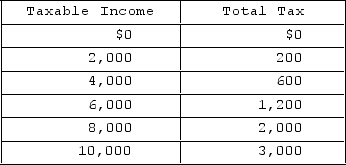

Refer to the personal income tax schedule given in the table. If your taxable income is $8,000, your average tax rate is

Refer to the personal income tax schedule given in the table. If your taxable income is $8,000, your average tax rate is

A) 25 percent; your marginal rate on the last $2,000 is 25 percent.

B) 25 percent; your marginal rate on the last $2,000 is 40 percent.

C) 25 percent; your marginal rate on the last $2,000 cannot be determined from the information given.

D) 20 percent; your marginal rate on the last $2,000 is 30 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q237: (Advanced analysis)The equations for the demand and

Q238: Total governmental purchases-federal, state, and local combined-accounted

Q239: Which of the following is the largest

Q240: Describe how the federal government functions within

Q241: Most economists believe that property taxes<br>A)should be

Q243: The main difference between sales and excise

Q244: If the demand for a product is

Q245: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Refer to the

Q246: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The graph shows

Q247: Suppose that government imposes a specific excise