Multiple Choice

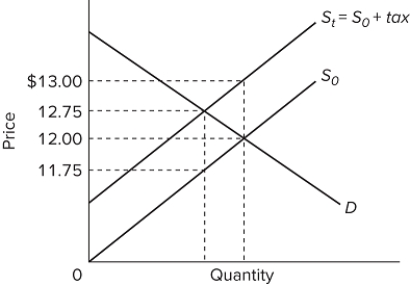

The graph shows the supply curve for a product before tax ( S ₀ ) and after an excise tax is imposed ( S ₁) . If 500 units of the product are sold after the tax is imposed, the amount of tax revenue going to the government is

The graph shows the supply curve for a product before tax ( S ₀ ) and after an excise tax is imposed ( S ₁) . If 500 units of the product are sold after the tax is imposed, the amount of tax revenue going to the government is

A) $125.

B) $250.

C) $375.

D) $500.

Correct Answer:

Verified

Correct Answer:

Verified

Q241: Most economists believe that property taxes<br>A)should be

Q242: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Refer to the

Q243: The main difference between sales and excise

Q244: If the demand for a product is

Q245: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Refer to the

Q247: Suppose that government imposes a specific excise

Q248: The federal personal income tax<br>A)has a regressive

Q249: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" In the diagram,

Q250: Which statement best describes the overall tax

Q251: If the supply of a product is