Multiple Choice

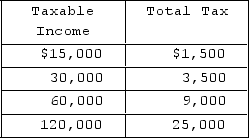

The table represents a personal income tax schedule. If income increases from $15,000 to $30,000, the marginal tax rate is

The table represents a personal income tax schedule. If income increases from $15,000 to $30,000, the marginal tax rate is

A) 10.0 percent.

B) 13.3 percent.

C) 18.3 percent.

D) 26.6 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q64: The largest source of tax revenue for

Q65: Transfer payments are "exhaustive" in that they

Q66: If a tax is progressive, then<br>A)the average

Q67: List the arguments for and against state

Q68: The incidence of a tax pertains to<br>A)the

Q70: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Refer to the

Q71: Proprietary income refers to<br>A)revenue flowing to the

Q72: The probable incidence of the tax on

Q73: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The graph illustrates

Q74: The two largest sources of tax revenue