Multiple Choice

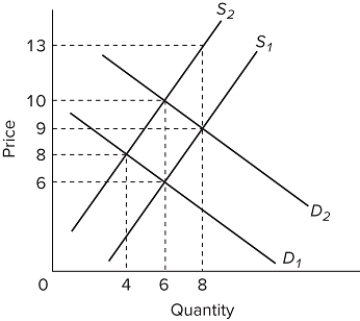

Refer to the graph. Assume the market for this product is initially in equilibrium at the intersection of D ₂ and S ₁. The shift in supply from S ₁ to S ₂ is due to an excise tax imposed on the product. The excise tax revenue collected by the government will be

Refer to the graph. Assume the market for this product is initially in equilibrium at the intersection of D ₂ and S ₁. The shift in supply from S ₁ to S ₂ is due to an excise tax imposed on the product. The excise tax revenue collected by the government will be

A) $60.

B) $36.

C) $32.

D) $24.

Correct Answer:

Verified

Correct Answer:

Verified

Q65: Transfer payments are "exhaustive" in that they

Q66: If a tax is progressive, then<br>A)the average

Q67: List the arguments for and against state

Q68: The incidence of a tax pertains to<br>A)the

Q69: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The table represents

Q71: Proprietary income refers to<br>A)revenue flowing to the

Q72: The probable incidence of the tax on

Q73: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The graph illustrates

Q74: The two largest sources of tax revenue

Q75: The overall tax structure of the United