Multiple Choice

Figure 8-11

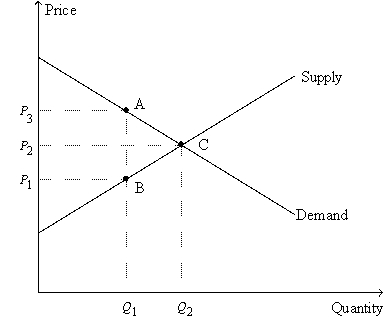

-Refer to Figure 8-11.Suppose Q₁ = 4; Q₂ = 7; P₁ = $6; P₂ = $8; and P₃ = $10.Then,when the tax is imposed,

A) consumer surplus decreases by $11.

B) producer surplus decreases by $11.

C) the deadweight loss amounts to $6.

D) All of the above are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q20: Taxes on labor tend to increase the

Q26: Figure 8-5<br>Suppose that the government imposes a

Q32: Figure 8-9<br>The vertical distance between points A

Q34: Economists generally agree that the most important

Q47: If the tax on a good is

Q76: Figure 8-9<br>The vertical distance between points A

Q105: The benefit to buyers of participating in

Q346: Suppose the government increases the size of

Q347: If the tax on a good is

Q348: The deadweight loss from a tax of