Essay

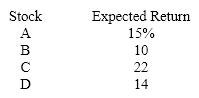

a. What is the expected return on a portfolio consisting of an equal amount invested in each stock?

b. What is the expected return on the portfolio if 50 percent of the funds are invested in stock C, 30 percent in stock A, and 20 percent in Stock D?

Correct Answer:

Verified

a. The expected return is the sum of the...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Diversification reduces<br>A)systematic risk<br>B)unsystematic risk<br>C)market risk<br>D)purchasing power risk

Q13: Sources of risk include<br>1. fluctuating exchange rates<br>2.

Q17: Investors seek to minimize risk for a

Q18: Given the following information: <br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9001/.jpg"

Q19: Sources of unsystematic risk include<br>1. the firm's

Q20: In a world of certainty, there would

Q22: What is the expected return on a

Q23: Reinvestment rate risk results from higher stock

Q24: A portfolio consisting of securities whose returns

Q25: Beta coefficients<br>1. are a measure of systematic