Essay

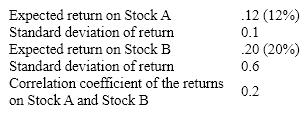

Given the following information:

a. What are the expected returns and standard deviations of the following portfolios?

1. 100 percent of funds invested in Stock A

2. 100 percent of funds invested in Stock B

3. 50 percent of funds invested in each stock?

b. What would be the impact if the correlation coefficient were -0.6 instead of 0.2?

Correct Answer:

Verified

a. The expected returns and standard dev...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Diversification reduces<br>A)systematic risk<br>B)unsystematic risk<br>C)market risk<br>D)purchasing power risk

Q13: Low beta stocks tend to generate higher

Q14: An efficient portfolio<br>1. maximizes risk for a

Q15: Arbitrage is the act of buying a

Q17: Investors seek to minimize risk for a

Q19: Sources of unsystematic risk include<br>1. the firm's

Q20: In a world of certainty, there would

Q21: a. What is the expected return on

Q22: What is the expected return on a

Q23: Reinvestment rate risk results from higher stock