Multiple Choice

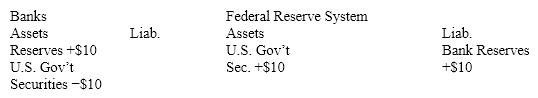

Table 29-1 Effects of an open-market transaction on the balance sheets of banks and the fed (in millions of dollars)  After the transaction in Table 29-1 is completed, what happens to actual reserves, required reserves, and excess reserves? Assume the required reserve ratio is 25 percent.

After the transaction in Table 29-1 is completed, what happens to actual reserves, required reserves, and excess reserves? Assume the required reserve ratio is 25 percent.

A) Actual reserves increase by $10 million, required reserves increase $2.5 million, and excess reserves increase by $7.5 million.

B) Actual reserves decrease by $10 million, required reserves decrease $2.5 million, and excess reserves decrease by $7.5 million.

C) Actual reserves increase by $10 million, required reserves are unchanged, and excess reserves increase by $10 million.

D) Actual reserves decrease by $10 million, required reserves decrease by $10 million, and excess reserves are unchanged.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Table 29-1 Effects of an open-market transaction

Q4: Table 29-1 Effects of an open-market transaction

Q10: Figure 29-1<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9029/.jpg" alt="Figure 29-1

Q42: Explain the relationship between interest rates and

Q62: Once the federal funds rate hits zero,

Q81: If the FOMC orders the sale of

Q123: When the Fed wants to expand the

Q139: The current chair of the Federal Reserve

Q170: How does a central bank influence the

Q204: When the Fed buys a Treasury bill