Multiple Choice

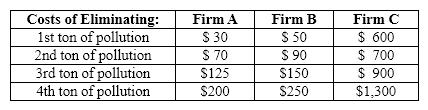

Exhibit 30-3  Refer to Exhibit 30-3. Suppose that Firms A, B, and C are the only polluters in the state and that each emits 4 tons of pollution into the atmosphere. To cut the level of pollution the government imposes an emission tax of $300 per ton of pollution. As a result of this tax, Firm A would _________________, firm B would ____________________ and firm C would __________________.

Refer to Exhibit 30-3. Suppose that Firms A, B, and C are the only polluters in the state and that each emits 4 tons of pollution into the atmosphere. To cut the level of pollution the government imposes an emission tax of $300 per ton of pollution. As a result of this tax, Firm A would _________________, firm B would ____________________ and firm C would __________________.

A) not reduce any of its pollution; not reduce any of its pollution; reduce all 4 tons of its pollution

B) reduce all 4 tons of its pollution; only reduce 1 ton of its pollution; not reduce any of its pollution

C) reduce all 4 tons of its pollution; reduce all 4 tons of its pollution; not reduce any of its pollution

D) not reduce any of its pollution; reduce 3 tons of its pollution; reduce all 4 tons of its pollution

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Exhibit 30-1 <br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9059/.jpg" alt="Exhibit 30-1

Q2: A nonexcludable public good is characterized by

Q4: Exhibit 30-2 <br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9059/.jpg" alt="Exhibit 30-2

Q6: The disagreement between A. C. Pigou and

Q10: A positive externality is internalized when<br>A)demand shifts

Q53: A side effect of an action that

Q68: A negative externality exists and government wants

Q116: The primary difference between private goods and

Q149: There are two divorce laws, A and

Q184: According to the Coase theorem, externalities<br>A)must usually