Multiple Choice

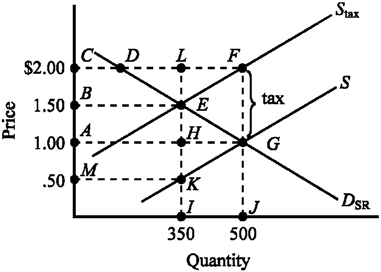

Use the figure below illustrating the impact of an excise tax to answer the following question(s) .

Figure 4-6

Refer to Figure 4-6. The amount of the actual tax burden paid by consumers and producers is

A) $1.00 for consumers and $.50 for producers

B) $1.00 for consumers and $1.00 for producers.

C) $.25 for consumers and $.75 for producers.

D) $.50 for consumers and $.50 for producers.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: If the government wants to generate large

Q110: Under rent control, landlords cease to be

Q134: The actual benefit of a government subsidy

Q162: Figure 4-25 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 4-25

Q164: Which of the following is correct?<br>A) An

Q167: Figure 4-19 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 4-19

Q168: Use the figure below to answer the

Q169: If an increase in the government-imposed minimum

Q261: Suppose the equilibrium price of a physical

Q268: The excess burden or deadweight loss of