Multiple Choice

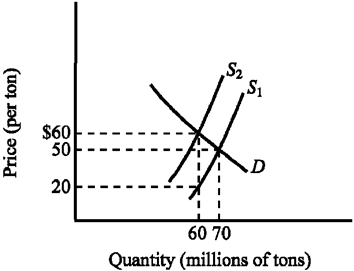

Use the figure below to answer the following question(s) .

Figure 4-8

Refer to Figure 4-8. Which of the following is true?

A) The tax increases the price of soft coal by $40 per ton.

B) Since the demand for soft coal is more inelastic than the supply, consumers bear most of the burden of the tax.

C) Since the demand for soft coal is more elastic than the supply, suppliers of soft coal bear most of the burden of the tax.

D) Since the supply of soft coal is highly inelastic, the primary burden of the tax is imposed on the consumers of soft coal.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: If the government wants to generate large

Q110: Under rent control, landlords cease to be

Q112: Deadweight losses are associated with<br>A) taxes that

Q164: Which of the following is correct?<br>A) An

Q166: Use the figure below illustrating the impact

Q167: Figure 4-19 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 4-19

Q169: If an increase in the government-imposed minimum

Q211: The Laffer Curve indicates that<br>A) when tax

Q261: Suppose the equilibrium price of a physical

Q268: The excess burden or deadweight loss of