Multiple Choice

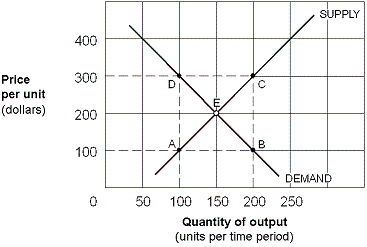

Exhibit 5-9 Supply and Demand Curves for Good X

In Exhibit 5-9, assume the government places a $200 per unit sales tax on Good X. The percentage of the burden of taxation paid by consumers of Good X is:

A) zero.

B) 25 percent.

C) 50 percent.

D) 100 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q62: Good A has a price elasticity of

Q63: Exhibit 5-1 Demand curve<br><br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8793/.jpg" alt="Exhibit 5-1

Q64: In the long run, price elasticities of

Q65: In order to prove that Dr. Pepper

Q66: Exhibit 5-8 Supply and demand curves for

Q68: If demand for a good is elastic,

Q69: The responsiveness of suppliers to changing prices

Q70: Using supply and demand analysis, which of

Q71: The demand for a product is likely

Q72: If the quantity of rental units increases