Multiple Choice

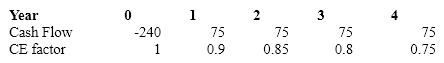

Zeta Inc.'s cost of capital is 12% and the risk-free rate is 5%. It plans to invest in a new project. The cash flow projections ($000) for the project are given below. Calculate the certainty equivalent NPV ($000) .

A) ($19.78)

B) $19.78

C) $12.20

D) ($12.20)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q67: The NPV and IRR of any capital

Q68: A real option's value may be more

Q69: Which of the following is not a

Q70: A company is evaluating a capital project

Q71: The appropriate interest rate to use in

Q73: Francis Corp is evaluating a capital budgeting

Q74: In capital budgeting:<br>A)If a firm accepts projects

Q75: Match the following:

Q76: The value of real options is approximately

Q77: Riskier projects should be harder to accept