Essay

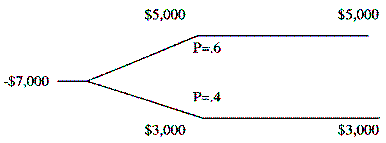

Francis Corp is evaluating a capital budgeting project and has come up with the following two branch decision tree analysis ($000). The firm's cost of capital is 12%. What is the project's NPV?

Correct Answer:

Verified

($000)

Upper Path: CFo=-7000,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

($000)

Upper Path: CFo=-7000,...

Upper Path: CFo=-7000,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q68: A real option's value may be more

Q69: Which of the following is not a

Q70: A company is evaluating a capital project

Q71: The appropriate interest rate to use in

Q72: Zeta Inc.'s cost of capital is 12%

Q74: In capital budgeting:<br>A)If a firm accepts projects

Q75: Match the following:

Q76: The value of real options is approximately

Q77: Riskier projects should be harder to accept

Q78: Which of the following is the appropriate