Multiple Choice

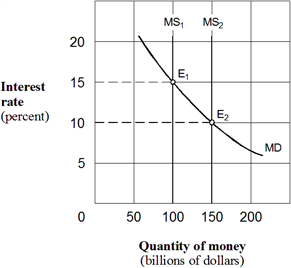

Exhibit 20-3 Money market demand and supply curves  In Exhibit 20-3, assume an equilibrium at E2 with the money supply at $100 billion and the interest rate at 15 percent. The Fed uses its policy tools to move the economy to a new equilibrium at E1 with a money supply of 150 billion and an interest rate of 10 percent. As part of the adjustment to the new equilibrium, we would expect the:

In Exhibit 20-3, assume an equilibrium at E2 with the money supply at $100 billion and the interest rate at 15 percent. The Fed uses its policy tools to move the economy to a new equilibrium at E1 with a money supply of 150 billion and an interest rate of 10 percent. As part of the adjustment to the new equilibrium, we would expect the:

A) price of bonds to rise.

B) price of bonds to remain unchanged.

C) price of bonds to fall.

D) none of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: The monetary rule is the view of

Q68: A decrease in the interest rate, other

Q92: In Keynes's view, an excess quantity of

Q167: If M stand for the money supply,

Q168: Exhibit 20-3 Money market demand and supply curves

Q169: Starting from equilibrium in the money market,

Q170: The Keynesian cause-and-effect sequence predicts that a

Q171: Exhibit 20A-2 Macro AD/AS Models <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9287/.jpg" alt="Exhibit

Q175: Monetarists argue that the Treasury's conduct of

Q177: According to the quantity theory of money:<br>A)