Multiple Choice

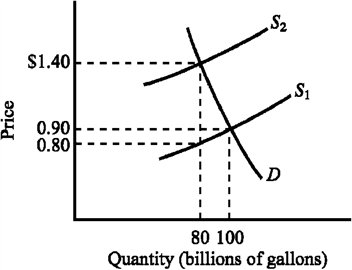

Use the figure below to answer the following question(s) . Figure 4-7 Refer to Figure 4-7. The supply curve S1 and the demand curve D indicate initial conditions in the market for gasoline. A $.60-per-gallon excise tax on gasoline is levied, which shifts the supply curve from S1 to S2. Which of the following states the actual burden of the tax?

Refer to Figure 4-7. The supply curve S1 and the demand curve D indicate initial conditions in the market for gasoline. A $.60-per-gallon excise tax on gasoline is levied, which shifts the supply curve from S1 to S2. Which of the following states the actual burden of the tax?

A) $.50 for buyers and $.10 for sellers

B) $.50 for sellers and $.10 for buyers

C) The entire $.60 falls on sellers.

D) The entire $.60 falls on buyers.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The deadweight loss (or excess burden) resulting

Q57: If a $2 tax per bottle of

Q76: Figure 4-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 4-22

Q78: Use the figure below to answer the

Q82: Figure 4-17 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 4-17

Q83: Figure 4-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 4-22

Q84: Figure 4-14 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 4-14

Q102: If a household has $40,000 in taxable

Q154: The benefit of a subsidy will go

Q250: If a government price control succeeds in