Multiple Choice

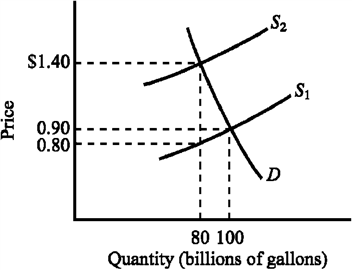

Use the figure below to answer the following question(s) . Figure 4-7 Refer to Figure 4-7. Which of the following is true for the tax illustrated?

Refer to Figure 4-7. Which of the following is true for the tax illustrated?

A) The tax increases the price of gasoline by $.60.

B) Since the demand for gasoline is more inelastic than the supply, consumers bear most of the burden of the tax.

C) Since the demand for gasoline is more elastic than the supply, consumers bear most of the burden of the tax.

D) Since the supply of gasoline is highly inelastic, the primary burden of the tax is imposed on the suppliers of gasoline.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Rent controls tend to cause persistent imbalances

Q19: Price controls will tend to cause misallocation

Q66: A law establishing a maximum legal price

Q179: Suppose the U.S. government banned the sale

Q194: A market that operates outside the legal

Q223: Emma works full time during the day

Q239: Use the figure below to answer the

Q243: Use the table below to choose the

Q244: Use the figure below to answer the

Q258: The more elastic the supply of a