Multiple Choice

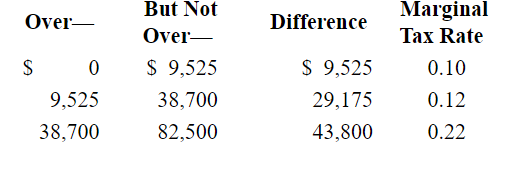

Following is a partial personal taxable income schedule for a single filer:  What would be the cumulative dollar amount of income taxes paid by a single filer who has taxable income of $38,700?

What would be the cumulative dollar amount of income taxes paid by a single filer who has taxable income of $38,700?

A) $922.50

B) $1,143.00

C) $3,501.00

D) $4,453.00

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q69: In which form of business organization is

Q70: Following is a partial personal taxable income

Q71: The articles of incorporation are the basic

Q72: Which form of business organization typically offers

Q73: Which of the following are intellectual property

Q75: Which of the following forms of protecting

Q76: The maximum number of owners in a

Q77: If you are an inventor with a

Q78: The highest federal marginal income tax rate

Q79: A limited partnership limits certain partners' liabilities