Multiple Choice

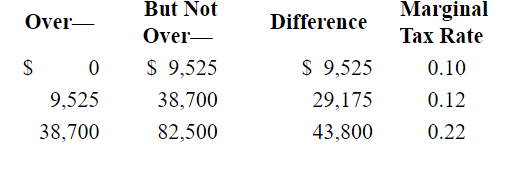

Following is a partial personal taxable income schedule for a single filer:  The average tax rate for a single filer with taxable income of $82,500 would be :

The average tax rate for a single filer with taxable income of $82,500 would be :

A) 12.0%

B) 17.1%

C) 18.6%

D) 22.0%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q65: In a corporate legal entity, the personal

Q66: Which of the following is not a

Q67: Partnerships are treated with pass-through taxation. This

Q68: A color mark is considered to be

Q69: In which form of business organization is

Q71: The articles of incorporation are the basic

Q72: Which form of business organization typically offers

Q73: Which of the following are intellectual property

Q74: Following is a partial personal taxable income

Q75: Which of the following forms of protecting