Multiple Choice

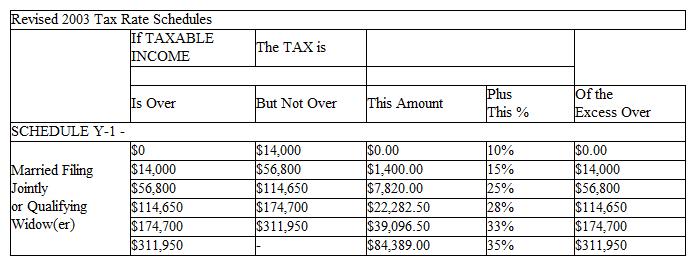

Raul has an adjusted income of $153,850, is married, and files jointly. Compute his tax.

A) $32,082.50

B) $10,976.00

C) $33,258.50

D) $22,282.50

E) $22,377.50

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q33: The magnitudes of the major earthquakes

Q34: Several computer stores reported differing prices for

Q35: Find the weighted mean of a

Q36: Refer to the following spinner. If

Q37: Use the data in the table

Q39: Find the semester grade point average

Q40: Match the type of information with the

Q41: An ordinary die is rolled once.

Q42: Use the data in the table

Q43: Refer to the line graph.<br>In approximately what