Essay

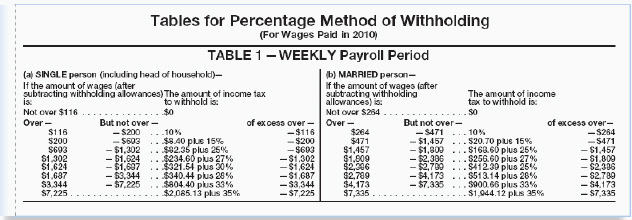

Maya Costello is married with two allowances. She has gross weekly earnings of $378.90. For each withholding allowance she can deduct $70.19 from her gross earnings. Use the percentage method table to find the amount of weekly federal income tax withheld.

Correct Answer:

Verified

$0 withheld; $378.90...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: Lewis is single with one allowance. He

Q41: In the last four weeks, Case Janson

Q42: The more withholding allowances that Rolanda claims,

Q43: Katelyn works from home assembling craft kits.

Q44: Josiah lives in a state with a

Q45: Tracy works from home entering data into

Q46: The FICA or Federal Insurance Contributions Act

Q47: Tanya Benson is single with three allowances

Q48: Terrence worked as a lifeguard 23 hours

Q50: Mrs. Thomson had gross earnings of $1,345.90