Multiple Choice

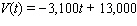

Straight-line depreciation is an accounting method used to help spread the cost of new equipment over a number of years. It takes into account both the cost when new and the salvage value, which is the value of the equipment at the time it gets replaced. The function  where V is value and t is time in years, can be used to find the value of a large copy machine during the first 4 years of use. What is the value of the copier after 1 years and 3 months?

where V is value and t is time in years, can be used to find the value of a large copy machine during the first 4 years of use. What is the value of the copier after 1 years and 3 months?

A) $8,970

B) $9,225

C) $4,475

D) $9,125

E) $4,630

Correct Answer:

Verified

Correct Answer:

Verified

Q112: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Let and

Q113: Given f = x <sup> 2 </sup>

Q114: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Let Evaluate

Q115: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Let and

Q116: Determine if each of the following tables

Q118: y varies inversely with the square of

Q119: y varies inversely with the square of

Q120: The training heart rate <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="The

Q121: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Let Evaluate

Q122: Let f ( x ) = 3