Multiple Choice

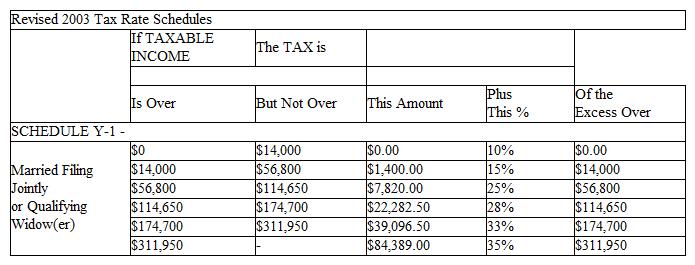

Raul has an adjusted income of $153,850, is married, and files jointly. Compute his tax.

A) $32,082.50

B) $10,976.00

C) $33,258.50

D) $22,282.50

E) $22,377.50

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q8: To the nearest two million, how many

Q22: Find the mode (if any) of the

Q31: Use the following bar graph to find

Q33: Match the type of information with the

Q34: The class results on a mathematical

Q34: Several computer stores reported differing prices for

Q35: Which of the following illustrations represents a

Q37: If the symbol <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8669/.jpg" alt="If the

Q38: An ordinary die is rolled once.

Q40: Which of the following illustrations is a