Multiple Choice

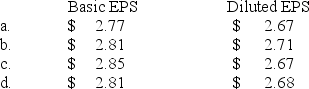

Ignatius Corporation had 7 million shares of common stock outstanding during the current calendar year. It issued ten thousand $1,000, convertible bonds on January 1. Each bond is convertible into 50 shares of common stock. The bonds were issued at face amount and pay interest semiannually at an annual rate of 10%. On June 30, Ignatius issued 100,000 shares of $100 par 6% cumulative preferred stock. Dividends are declared and paid quarterly. Ignatius has an effective tax rate of 40%. Ignatius would report the following EPS data (rounded) on its net income of $20 million:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q95: Listed below are five terms followed by

Q96: When computing earnings per share, noncumulative preferred

Q97: Listed below are five terms followed by

Q98: Green Company is a calendar-year U.S. firm

Q99: As part of its stock-based compensation package,

Q101: Rudyard Corporation had 100,000 shares of common

Q102: On December 31, 2017, the Frisbee Company

Q103: What is an antidilutive security?

Q104: Gear Corporation had the following common

Q221: Listed below are 5 terms followed by