Multiple Choice

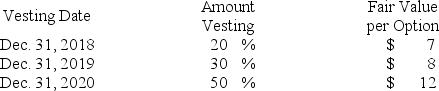

Green Company is a calendar-year U.S. firm with operations in several countries. At January 1, 2018, the company had issued 40,000 executive stock options permitting executives to buy 40,000 shares of stock for $25. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting) . The fair value of the options is estimated as follows:  Assuming Green uses the straight-line method, what is the compensation expense related to the options to be recorded in 2019?

Assuming Green uses the straight-line method, what is the compensation expense related to the options to be recorded in 2019?

A) $130,667.

B) $200,000.

C) $333,333.

D) $400,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q93: Dulce Corporation had 200,000 shares of common

Q94: Listed below are five terms followed by

Q95: Listed below are five terms followed by

Q96: When computing earnings per share, noncumulative preferred

Q97: Listed below are five terms followed by

Q99: As part of its stock-based compensation package,

Q100: Ignatius Corporation had 7 million shares of

Q101: Rudyard Corporation had 100,000 shares of common

Q102: On December 31, 2017, the Frisbee Company

Q103: What is an antidilutive security?