Multiple Choice

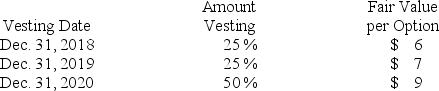

Yellow Company is a calendar-year firm with operations in several countries. At January 1, 2018, the company had issued 40,000 executive stock options permitting executives to buy 40,000 shares of stock for $30. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting) . The fair value of the options is estimated as follows:  Assuming Yellow prepares its financial statements in accordance with International Financial Reporting Standards (IFRS) , what is the compensation expense related to the options to be recorded in 2019?

Assuming Yellow prepares its financial statements in accordance with International Financial Reporting Standards (IFRS) , what is the compensation expense related to the options to be recorded in 2019?

A) $40,000.

B) $60,000.

C) $95,000.

D) $130,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q155: The tax code differentiates between qualified and

Q156: Nonconvertible bonds affect the calculation of:<br>A) Basic

Q157: M, Inc. supplies consumer products used in

Q158: Which of the following statements is true

Q159: How many types of potential common shares

Q161: Why are earnings per share figures for

Q162: The compensation associated with executive stock option

Q163: On January 1, 2018, Cori Ander Herbs

Q164: A simple capital structure might include:<br>A) Stock

Q165: On October 1, 2018, Iona Ford Co.