Multiple Choice

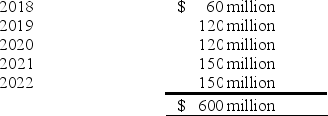

Isaac Inc. began operations in January 2018. For certain of its property sales, Isaac recognizes income in the period of sale for financial reporting purposes. However, for income tax purposes, Isaac recognizes income when it collects cash from the buyer's installment payments. In 2018, Isaac had $600 million in sales of this type. Scheduled collections for these sales are as follows:  Assume that Isaac has a 30% income tax rate and that there were no other differences in income for financial statement and tax purposes.

Assume that Isaac has a 30% income tax rate and that there were no other differences in income for financial statement and tax purposes.

-

Ignoring operating expenses and additional sales in 2019, what deferred tax liability would Isaac report in its year-end 2019 balance sheet?

A) $54 million.

B) $144 million.

C) $126 million.

D) $180 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q81: Bumble Bee Co. had taxable income of

Q82: Listed below are five independent situations. For

Q83: Information for Hobson Corp. for the current

Q84: The following information relates to Franklin Freightways

Q85: A result of inter-period tax allocation is

Q87: Which of the following differences between financial

Q88: In its 2018 annual report to shareholders,

Q89: Which of the following circumstances creates a

Q90: Listed below are 5 terms followed by

Q91: A reconciliation of pretax financial statement income