Multiple Choice

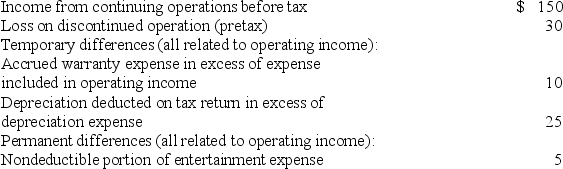

Information for Hobson Corp. for the current year ($ in millions) :  The applicable enacted tax rate for all periods is 40%.

The applicable enacted tax rate for all periods is 40%.

- What should Hobson report as net income?

A) $70 million.

B) $72 million.

C) $75 million.

D) $88 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q78: Plutonic Inc. had $400 million in taxable

Q79: Several years ago, Western Electric Corp. purchased

Q80: Four independent situations are described below. Each

Q81: Bumble Bee Co. had taxable income of

Q82: Listed below are five independent situations. For

Q84: The following information relates to Franklin Freightways

Q85: A result of inter-period tax allocation is

Q86: Isaac Inc. began operations in January 2018.

Q87: Which of the following differences between financial

Q88: In its 2018 annual report to shareholders,