Multiple Choice

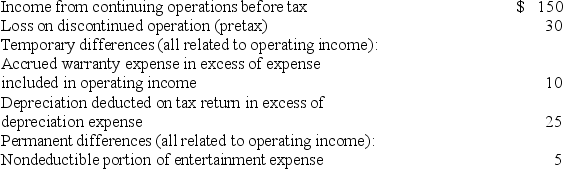

Information for Hobson Corp. for the current year ($ in millions) :  The applicable enacted tax rate for all periods is 40%.

The applicable enacted tax rate for all periods is 40%.

- How much tax expense on income from continuing operations would be reported in Hobson's income statement?

A) $56 million.

B) $60 million.

C) $62 million.

D) $50 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: According to GAAP for accounting for income

Q13: The information that follows pertains to Julia

Q14: Which of the following differences between financial

Q15: A deferred tax asset represents the tax

Q16: Listed below are five independent situations. For

Q18: Which of the following creates a deferred

Q19: Changes in enacted tax rates that do

Q20: Which of the following causes a permanent

Q21: The following information is for Hulk Gyms'

Q22: Pretax accounting income for the year ended