Essay

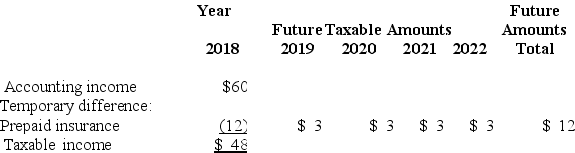

The following information is for Hulk Gyms' first year of operations. Amounts are in millions of dollars. The enacted tax rate is 30%.  Required:

Required:

Prepare a compound journal entry to record the income tax expense for the year 2018. Show well-labeled computations.

Correct Answer:

Verified

Journal entry to re...

Journal entry to re...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Listed below are five independent situations. For

Q17: Information for Hobson Corp. for the current

Q18: Which of the following creates a deferred

Q19: Changes in enacted tax rates that do

Q20: Which of the following causes a permanent

Q22: Pretax accounting income for the year ended

Q23: What is a valuation allowance for deferred

Q24: Revenues from installment sales of property reported

Q25: Theodore Enterprises had the following pretax

Q26: In the statement of cash flows, by