Multiple Choice

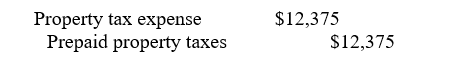

Eldora, Inc. paid property taxes of $16,500 on June 30, 2012, for the period July 1, 2012, to June 30, 2013, and debited prepaid property tax expense. Eldora, Inc. uses a fiscal year end of September 30 for financial purposes. What journal entry should be made to recognize property tax expense for the period October 1, 2012, to June 30, 2013?

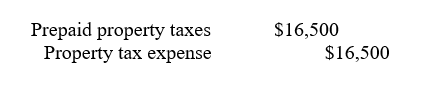

A)

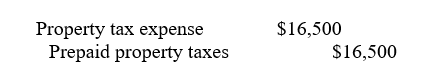

B)

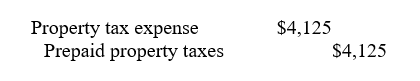

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q67: Diluted earnings per share includes stock transactions

Q68: Income taxes shown on the income statement

Q69: A severance package would best be termed

Q70: Earnings per share is NOT calculated on

Q71: Bristol Company's accounting records contained the following

Q73: Romulus Corporation incurred the following losses during

Q74: Marino, Inc. makes a sale and collects

Q75: A pension fund is "under-funded" when the<br>A)

Q76: Accounting rules give specific instructions on whether

Q77: A cash compensation received by an employee