Multiple Choice

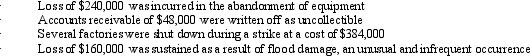

Romulus Corporation incurred the following losses during 2012:  Assuming that Romulus has a 40% income tax rate, what amount of net loss should Romulus report as extraordinary on its annual income statement?

Assuming that Romulus has a 40% income tax rate, what amount of net loss should Romulus report as extraordinary on its annual income statement?

A) $96,000

B) $144,000

C) $259,200

D) $499,200

Correct Answer:

Verified

Correct Answer:

Verified

Q68: Income taxes shown on the income statement

Q69: A severance package would best be termed

Q70: Earnings per share is NOT calculated on

Q71: Bristol Company's accounting records contained the following

Q72: Eldora, Inc. paid property taxes of $16,500

Q74: Marino, Inc. makes a sale and collects

Q75: A pension fund is "under-funded" when the<br>A)

Q76: Accounting rules give specific instructions on whether

Q77: A cash compensation received by an employee

Q78: The following information relates to the defined